The ACH Network—the invisible engine powering millions of electronic payments—continues to expand its role as the backbone of U.S. payments. In 2025, it’s not just growing; it’s accelerating across faster payments, business transactions, and personal transfers. Here’s a look at the remarkable momentum ACH has built and what it means for financial institutions ready to capitalize on this continued growth.

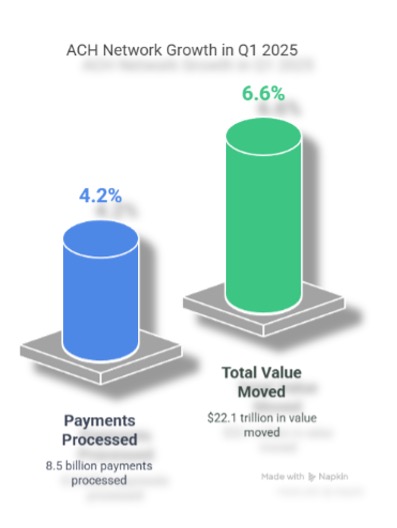

ACH Network Starts 2025 with Record Growth

From direct deposits and bill payments to business transactions and P2P transfers, ACH remains essential to how money moves in the U.S. This steady expansion underscores the growing preference for secure, efficient electronic payments over traditional paper-based transactions.

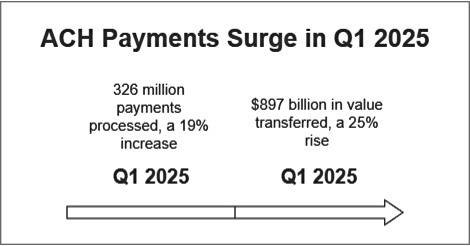

Same Day ACH: The Faster Payment Revolution

Same Day ACH is redefining speed and convenience in payments, with settlement times compressed into hours rather than days. It’s fast becoming the go-to option for both businesses and consumers needing rapid transactions.

As Same Day ACH approaches the $1 trillion mark in quarterly value, it’s clear this faster payment option is reshaping expectations. According to Nacha President and CEO Jane Larimer:

“As Same Day ACH nears moving one trillion dollars in a quarter, it’s becoming a go-to option for many.”

Businesses Accelerate Digital Payment Adoption

Businesses are rapidly shifting away from checks and embracing digital payments, driving significant growth in ACH-based business transactions:

- 1.9 billion B2B payments processed in Q1 2025—a 9% increase year-over-year

- Enhanced cash flow from faster settlements

This transformation is about more than efficiency—it’s reshaping how businesses manage financial operations and relationships.

P2P Payments Reach New Heights

Consumers are increasingly utilizing the ACH network for person-to-person (P2P) payments:

- 109 million P2P payments processed in Q1 2025—a 20% increase year-over-year

From splitting dinner bills to paying independent contractors, P2P via ACH offers security and efficiency. This growth reflects a generational shift away from cash and checks toward fully digital payments for everyday needs.

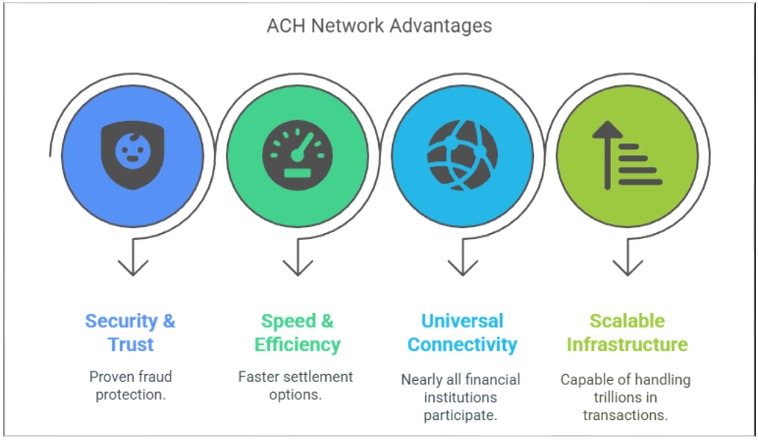

The Cornerstones of ACH’s Continuing Success

The ACH Network thrives because it combines trusted reliability with continuous innovation:

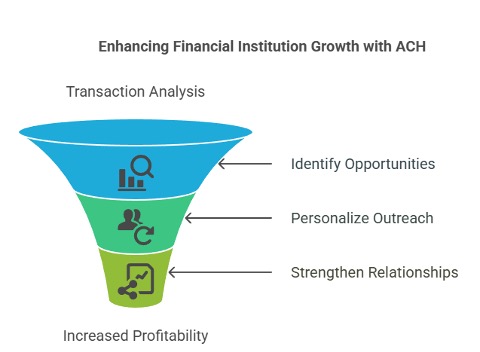

Leverage ACH Growth Trends with IFM

The continued rise in ACH transactions presents significant opportunities for financial institutions. Here’s how IFM helps you harness these trends:

- Identify Emerging Opportunities: Uncover growth segments in your customer base with transaction analysis that highlights shifting payment behaviors.

- Personalize Customer Outreach: Deliver timely, relevant messaging to businesses as they move away from checks, or consumers that are adopting P2P payments.

- Strengthen Relationship Value: Deepen engagement across segments with insights that identify cross-sell opportunities and enhance profitability.

Stay Ahead of the ACH Payments Curve

ACH isn’t just changing how money moves—it’s creating opportunities for forward-thinking institutions. IFM’s analytics help you transform raw transaction data into actionable strategies for growth.

Take the Next Step:

- Schedule a consultation with an IFM transaction data expert

- Request a demo of IFM’s transaction analytics platform

- Explore custom solutions for your institution’s unique needs

Let’s turn these ACH trends into smarter growth strategies for your financial institution. Contact us today to learn how IFM’s cutting-edge customer insights and solutions can help you strengthen customer relationships and drive long-term retention.

Rob Reale is an Associate Partner and National Sales Manager responsible for business development and sales at Insight Financial Marketing. Rob began working in the Mortgage Banking industry in 1990 and currently helps the financial service industry leverage unique and innovative solutions.